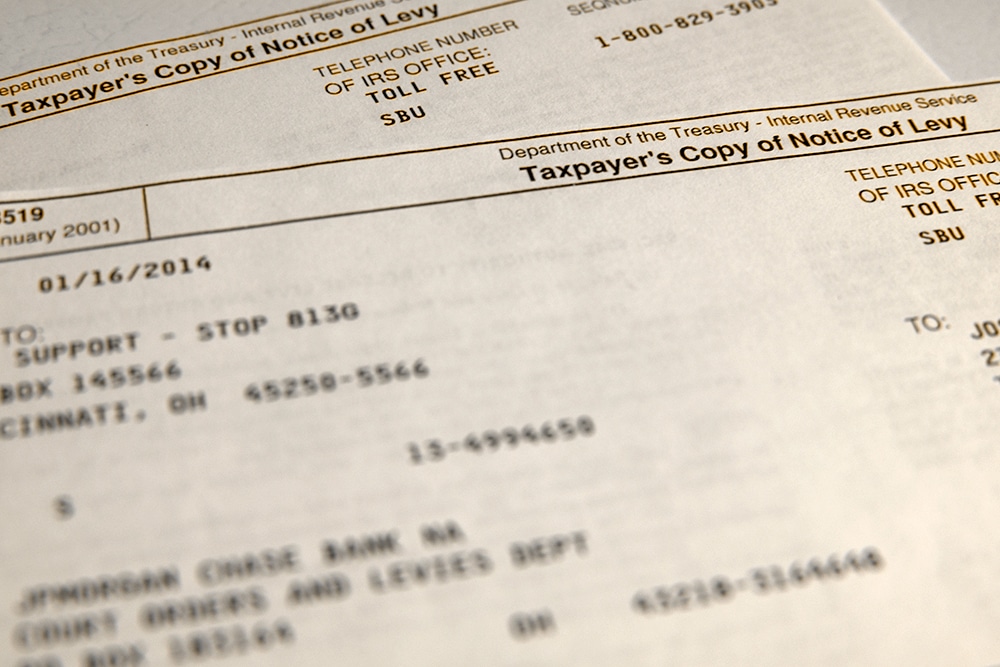

“Final Notice of Intent to Levy” the letter says in bold font. It arrived today via certified mail in an official looking envelope indicating it is from the Internal Revenue Service. Not good news. You have successfully ignored all the other letters you have received nicely asking for payment, but this one is different. The tax man is now doing more than asking, he is now going to take, and take a lot.

What can you do now? How about read the United States Constitution – you know, the document drafted so many years ago by men so far away in a small convention hall in Philadelphia in the late 1700’s. Amendment number five of the Bill of Rights to be exact. “No person shall…be deprived of life, liberty or property without due process of law…” This actually means something. These are more than just words mumbled in your high school social studies course! They mean that the IRS cannot take your stuff unless and until it provides you with due process of law. What the heck does that mean? That is simple – notice and a hearing. You have received the notice today via certified mail. Yes, the mail you received today is the first leg of the IRS complying with your Constitutional rights to due process of law before they take your stuff.

The second leg, a hearing, is vitally important and must be understood. If you look inside the envelope containing your notice of levy you will find IRS Form 12153, Request for a Collection Due Process (CDP) Hearing or Equivalent Hearing. The IRS is required by law to send you this form and an explanation of what it means. If this form is not there go to the IRS website at www.irs.gov and look under Forms and Publications. Download the form and instructions. This form is your best defense against the IRS taking your stuff today. By filling it out, you are exercising your Constitutional right to be heard by a neutral hearing officer before your bank account is emptied.

Have you found the form? Yes? Good. Fill it out and mail it in. The front of the form is quite easy containing basically personal information that you should be easily able to provide. The back is a little more complicated with blocks marked Installment Agreement, Offer in Compromise, Innocent Spouse.

In block 5 under Basis for Hearing Request mark Proposed Levy or Actual Levy. Block 6 should be checked as well. This requires some explanation. There are two types of hearings that are available to you depending upon when you are filling out the form – (1) the CDP Hearing and (2) the Equivalent Hearing. The CDP hearing is by far the better of the two. You have thirty days from the date of the Notice of Intent to Levy to request a CDP hearing. If you submit your request on time, i.e. within that thirty day window, the IRS is prohibited from taking your stuff. The levy will stop and you will be provided the opportunity to discuss your case with a neutral hearing officer form the Office of Appeals.

However, if you do not submit your request within the thirty days provided by law, you will not be able to request a CDP hearing and the levy will proceed. Fortunately you can still request a hearing (the Equivalent Hearing) but it will not stop levy action. Sorry.

Checking block six can’t hurt, it can only help. If you have submitted the Form 12153 within 30 days, block six really does not apply. If you submit later than thirty days it is vital.

Block seven is also vital but it can be a little confusing. Let’s start with the block titled “My Spouse is Responsible.” This involves “Innocent Spouse Relief” a concept which is beyond the scope of this article. If you feel that you are being unfairly targeted by the IRS for a tax debt that legitimately belongs to your spouse or ex spouse, do additional research on Innocent Spouse Relief and check this block. If you are not married or if you are married and responsible for the debt, then leave the block unchecked.

Moving on to the space marked “Lien.” Since you have not received a notice of lien, but rather a notice of levy, this block does not apply to you at this time.

The first block in section 7 has two simple choices – Installment Agreement and Offer in Compromise. Check both. This indicates to the IRS that you cannot fully pay the tax debt now and you want to be considered for either an Installment Agreement or an Offer in Compromise. If you are like most taxpayers, you certainly cannot pay the full amount now and at best can pay some of it over time. Alternatively, you might want to offer the IRS some amount less than the full extent of what you owe. That is called the offer in compromise. By mailing this to the IRS within thirty days, you will stop the levy action and give yourself the opportunity to discuss the debt with an IRS representative.

If you mail it later than the thirty day window, then you will be requesting an Equivalent Hearing and not a CDP hearing. While the actual meeting and hearing are basically the same, the single important difference is that the IRS will continue with their levy action. You can try to stop the levy action by contacting the IRS and discussing a 120 day hold on the levy while you go through the hearing process. The IRS is not bound by law to put the levy on hold for 120 days, but if you can present a good reason for failure to pay your taxes, they may stop the levy to give you time to explore collection alternatives with the hearing officer.

All of the above presumes that you do not dispute the fact that you owe the money. However, if you feel that the IRS has made an error and that you do not owe what they claim you do, then there are other avenues, in addition to the above that you should pursue. Those avenues are outside the scope of this article.

Arthur Weiss, Esquire

Law Office of Arthur Weiss, P.C.

2135 Grant Rd.

Tucson, AZ 85719

520-319-1124

https://artweisslaw.com